Flat tax

Elected officials have proposed raising the sales tax to help fund. A flat tax could also eliminate altogether some taxes that wealthier individuals tend to pay such as capital gains dividends and interest income taxes.

Flat Tax Definition Examples Features Pros Cons

We are part of The Trust Project.

. At the same time Michigan increased its personal exemption. Rates do increase however based on geography. A granny flat arrangement is a written agreement that gives an eligible person the right to occupy a property for life.

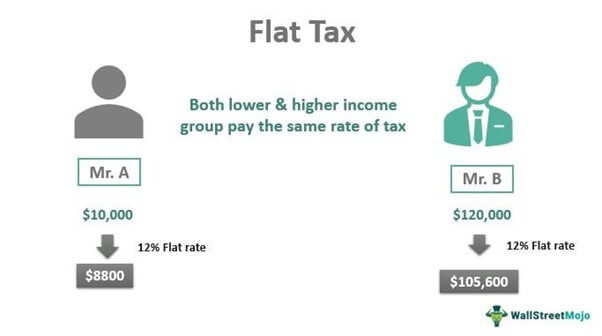

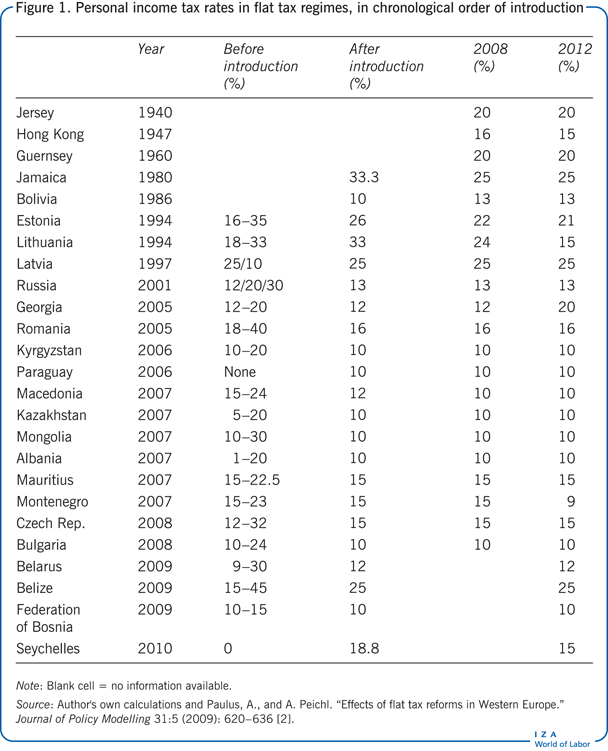

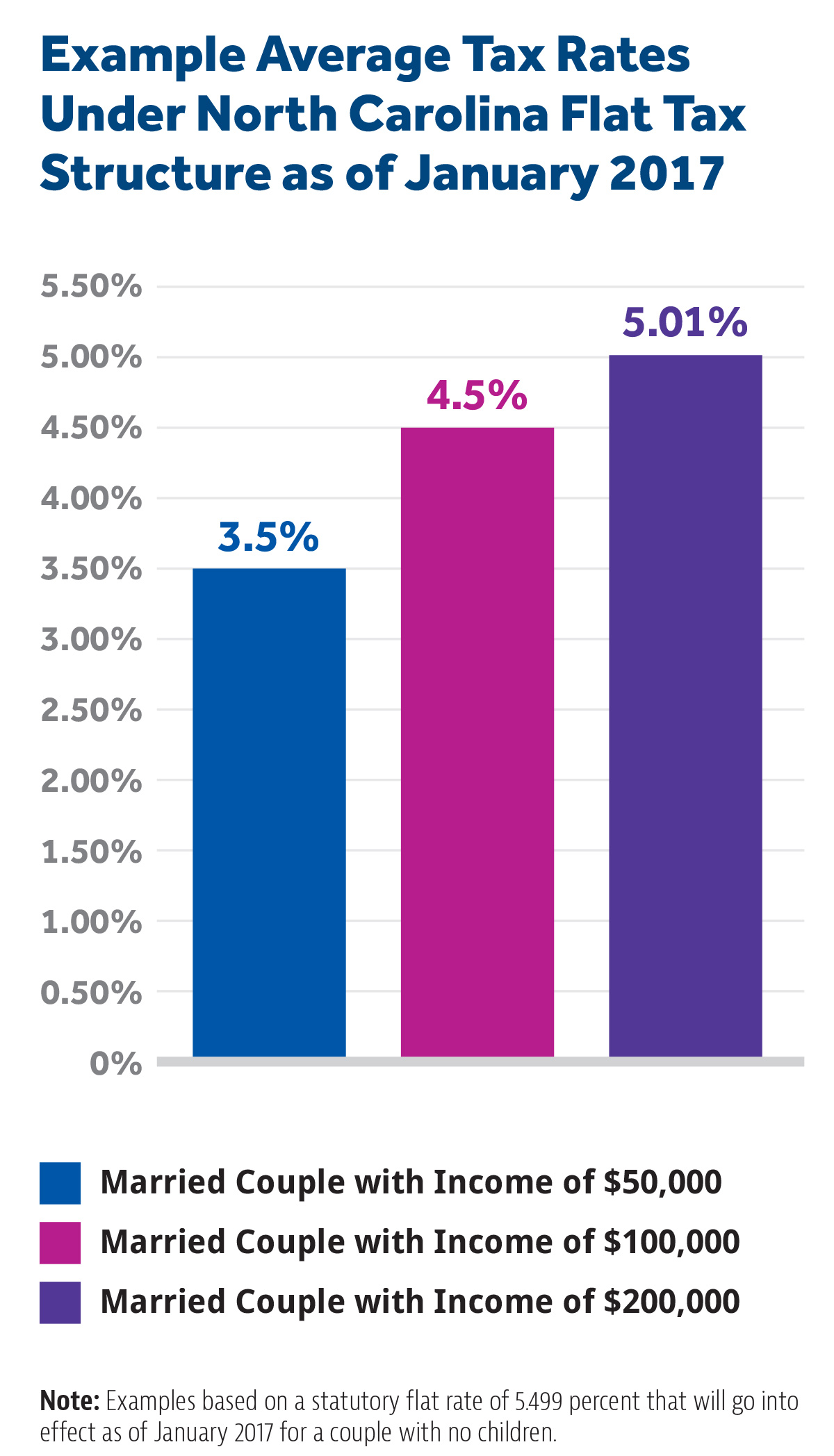

A proportional tax is a tax imposed so that the tax rate is fixed with no change as the taxable base amount increases or decreases. A flat tax system could greatly reduce taxes on the richest Americans. Flat tax supporters often cite the nation of Estonia as proof of the systems benefits.

Indianas 92 counties levy their own income taxes. You are introducing a bill to cut North Dakotas income tax. A granny flat arrangement is exempt from CGT if.

Doug Burgum State Tax Commissioner Brian Kroshus and Rep. The flat tax would eliminate the class envy argument abolish the hated Internal Revenue Service and put more money in the pockets of people who earn it instead of sending greater amounts to the. The flat tax would eliminate the class envy argument abolish the hated Internal Revenue Service and put more money in the pockets of people who earn it instead of sending greater amounts to the.

On September 1 Idaho lawmakers passed a tax cut proposed by Governor Brad Little that. The flat tax would eliminate the class envy argument abolish the hated Internal Revenue Service and put more money in the pockets of people who earn it instead of sending greater amounts to the. From 1 July 2021 capital gains tax CGT does not apply when a granny flat arrangement is created varied or terminated.

Proportional describes a distribution effect on income or expenditure referring to the way the rate remains consistent does not progress from low to high or high. San Francisco Income Tax Information. Other than the.

Businesses would only be required to pay a one-time 10 repatriation tax on past income. Pinned between Russia and the Baltic Sea Estonia is a tiny country with under two million residents. Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes.

The next time Republicans control all three branches of government they may wish to visit an old idea the flat tax. Shift tax burden to lower and middle classes. In some states companies with operations in that state may also be liable for the.

The flat tax system would also eliminate the estate tax Obamacare taxes as well as the Alternative Minimum Tax. In 2012 Michigans statewide flat tax rate fell from 435 to 425 although the city income taxes levied by 24 Michigan cities including Detroit were untouched. When magazine publisher and Republican Steve Forbes ran for president in.

Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. The tax proposal would also reduce corporate taxes to 16 while profits earned abroad would be tax-free. Michigan has a single sales tax rate of 6.

Its very likely that the Biden tax proposal which raises the federal tax rate from about 40 percent today to a new 55 percent tax rate a new 15 percent payroll tax plus a 40 percent income. Unlike the federal income tax system rates do not vary based on income level. The proposed flat tax is the culmination of years of tax relief work according to Lt.

When the CGT exemption applies. A tax levied at the state level against businesses and partnerships chartered within that state. Salvini called for the 15 per cent flat tax for all Italians as part of his electoral campaign which he has stated he is focused primarily and security issues and economic issues.

Right now there are 2 million VAT numbers that pay a flat tax at 15 per cent I would like to extend this flat taxation also to employees. Starting September 19 express views on where key futures product prices will close for the day by choosing a side. 2 days agoLawmakers in Georgia Mississippi Iowa and Arizona passed bills in 2021 and 2022 to move to a flat tax.

It took a lot to get here he said. The amount of the tax is in proportion to the amount subject to taxation. Tax rates range from 10 to 37 depending on income.

Nonresidents who work in San Francisco also pay a local income tax of 150 the same as the local income tax paid by residents.

The Winners And Losers If Alberta Returns To A Flat Tax System Macleans Ca

The Case For Flat Taxes The Economist

Iza World Of Labor Flat Rate Tax Systems And Their Effect On Labor Markets

The Winners And Losers If Alberta Returns To A Flat Tax System Macleans Ca

The Flat Tax Fantasy Part 2 Blessed By The Potato

The Flat Tax Good Idea Yip Institute

Progressivity And The Flat Tax

The Flat Tax Falls Flat For Good Reasons The Washington Post